The New York Post has the story of the shifting goalposts when it comes to the executive compensation at the New York Times company. This is the same New York Times whose Pulitzer prize winning business writer has a series of articles called Gilded Paychecks. As our friend Don Luskin wryly noted today,

WHERE’S GRETCHEN MORGENSON WHEN WE NEED HER?

The New York Time’s true crime reporter on the business beat somehow managed to overlook this story, which would seem to fall so neatly into her usual narrative about how corporate mangement enriches itself with incentives that kick in even when the company performs poorly.

Here’s the story from today’s New York Post,

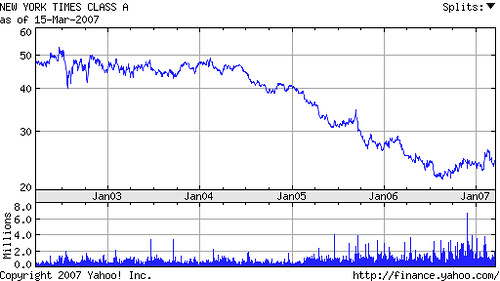

March 15, 2007 — Even steep losses at The New York Times didn’t stop its family owners from enriching themselves and insiders with bonuses for making “profits” when there were none.

Although its board acknowledged in filings yesterday that the media company lost $3.76 per share in 2006, directors revised its bottom-line bonus formula to exclude embarrassing write-downs, converting millions in losses into instant profits of $1.58 per share….

…Chairman Arthur “Pinch” Sulzberger, 55, failed to meet his company’s original targets based on earnings per share, but the board voted anyway to let him collect as much as $3.4 million in bonus and stock awards by using more optimistic cash flows instead of final earnings per share.

I don’t know which is worse, the greed of Chairman Arthur “Pinch” Sulzberger and his management team or their hypocrisy? What do you think?