According to Morningstar, best CEO in 2008 was Warren Buffett. Way to go out on a limb!

Investors can learn a lot from studying Buffett’s actions, but his decisions to stay on the sidelines are also notable. Indeed, he steered Berkshire Hathaway from many of the temptations that have caused competitors to crash and burn this past year. For instance, Buffett warned back in 2003 that derivatives were “financial weapons of mass destruction” that are “time bombs, both for the parties that deal in them and the economic system.” Given all that has transpired in 2008, these statements–and Berkshire’s actions–look especially prescient. While American International Group , Ambac (NYSE:ABK – News), and other competitors now wallow in bankruptcy or near-bankruptcy, Berkshire is as financially healthy as ever.

Beyond derivatives, Berkshire also avoided excessive leverage back when credit was flowing a little too easy and asset prices were too high. In mid-2007, the opening salvos of the credit crisis were being shot across the subprime mortgage market, and many financial firms were levered to the hilt. Yet Berkshire had $47 billion–over one third of its equity at the time–in cash and cash equivalents, most of it unencumbered. By practicing prudence and patience earlier in the decade, Berkshire was in a position to put large amounts of capital to work in 2008. In other words, rather than blowing its ammunition hunting squirrels a few years ago, Berkshire has been able to shoot the proverbial elephants now walking by.

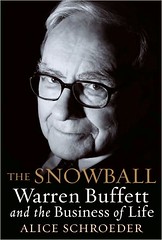

Alice Schroeder’s Snowball: Warren Buffett and the business of life was one of the best books of 2008. The first authorized biography of Buffet was anything but a puff piece. This was a warts and all account of a fascinating man. I had the pleasure of spending about 40 minutes talking with Ms. Schroeder about this book.