Dean Barnett from The Weekly Standard was back in to the studio last night. We talked about the Wall Street crisis. Isn't it amazing how they can spend $700 billion in 48 hours on a 3-page deal. Unreal.

What is Pundit Review Radio?

Pundit Review Radio is where the old media meets the new. Each week we give voice to the work of the most influential leaders in the new media/citizen journalist revolution. Called "groundbreaking" by Talkers Magazine, this unique show brings the best of the blogs to your radio every Sunday evening from 7-10 pm EST on AM680 WRKO, Boston's Talk Station.

Bruce McQuain from QandO joined us once again for Someone You Should Know, our weekly tribute to the troops. Bruce is a veteran of the Vietnam war and spent 28 years in the U.S. Army. He brings a perspective and understanding to these stories that we could never match. Dean Barnett and I welcomed Bruce who talked about Marine Sergeant Jeff Hunter,

“I honestly don’t believe I did anything all that heroic,†Sgt. Jeff Hunter told Military.com when asked about his Silver Star. That’s a common refrain among American warriors serving in combat zones, but for those who served with Hunter during two intense fights, it’s a dramatic understatement.

The Someone You Should Know radio collaboration began as an extension of Matt Burden’s series at Blackfive. Bruce McQuain from QandO does an incredible job with the series every week.

What is Pundit Review Radio?

Pundit Review Radio is where the old media meets the new. Each week we give voice to the work of the most influential leaders in the new media/citizen journalist revolution. Called “groundbreaking” by Talkers Magazine, this unique show brings the best of the blogs to your radio every Sunday evening from 7-10 pm EST on AM680 WRKO, Boston’s Talk Station.

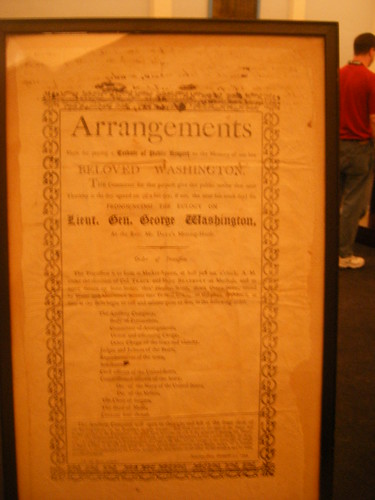

I read in the paper that this piece of history would be on display about 20 minutes from home and I couldn’t resist. This bible was printed in 1767 and used at George Washinton’s inauguration on April 30, 1789. It has also been used in some of the most regrettable events in our history, like Lincoln’s funeral and Jimmy Carter’s inauguration.

Here is how the Free Masons of St. John’s Lodge No. 1, tell the story of the George Washington Inaugural Bible,

“On April 30, 1789, an event took place of the greatest importance to the whole world. It was the inauguration of George Washington as the first President of the United States, on the spot marked today by his statue erected in Wall Street, near Nassau…

…“Everything was ready for the administration of the oath of office to the president of the new government, when it was found that there had not been provided a Holy Bible on which the President-elect could swear allegiance to the Constitution, Jacob Morton, who was Marshal of the parade and at that time, Master of St. John’s Lodge, was standing close by, and, seeing the dilemma they were in, remarked that he could get the altar Bible of St. John’s Lodge, which met at the “Old Coffee House,” corner of Water and Wall Streets. Chancellor Livingston begged him to do so. The Bible was brought, and the ceremony proceeded.

In the wake of the S.E.C.’s temporary ban on short selling of financial stocks I think it is important to remember that they play a critical role on Wall Street. Most of us want stocks to go up. They bet that they will go down. They play an important role as contrarians, questioners of conventional wisdom.

Two of America’s most spectacular bankruptcies were identified by shorts long before the rest of Wall Street had figured it out. Remember Enron?

The all-time most famous incident of gruff-talking CEOs is of course Jeffrey Skilling berating hedge fund manager Richard Grubman back in 2001 with a word we can’t print in a family-friendly investment blog. Grubman had challenged Skilling over Enron’s failure to produce cash flow and balance sheet data in a timely fashion. Turns out Grubman was on to something in them there balance sheets and Skilling’s less-than-professional response was a leading indicator of Enron’s subsequent decline and fall.

Here is a New York Times article from June 4, when Lehman Brothers was trading at $30 per share.

Lehman Battles an Insurgent Investor

For eight months now, Mr. Einhorn, a rabble-rousing hedge fund manager, has pilloried the venerable Lehman Brothers in an effort to drive down the bank’s stock price, which he is betting against…He questioned how the company valued the assets on its books, and whether it was disclosing all the risks it faces…“Lehman has been one of the deniers,†Mr. Einhorn, 39, said.

A lot of people could have saved a lot of money if they had heeded these warnings. Shorts improve liquidity and often provide cold blooded rational thinking when others have been swept up by irrational exuberance.

The following is a response submitted to my local paper this afternoon…

Editorial page editor Nelson Benton wrote the following this morning,

“Democrats will be seeking to take advantage of Republican presidential candidate John McCain’s deregulation fervor in the weeks ahead.â€

No doubt the Democrats will try to blame McCain for this financial crisis. The question is, can they do that credibly? Furthermore, by referring to John McCain’s “deregulation fervor,†Mr. Benton is making a false assumption that needs to be corrected.

According to a Washington Post editorial published on Friday,

“In the aftermath of the Enron collapse and other accounting scandals, he (McCain) was a leader, with Sen. Carl M. Levin (D-Mich.), in pushing to require that companies treat stock options granted to employees as expenses on their balance sheets. â€I have long opposed unnecessary regulation of business activity, mindful that the heavy hand of government can discourage innovation,” he wrote in a July 2002 op-ed in the New York Times. “But in the current climate only a restoration of the system of checks and balances that once protected the American investor — and that has seriously deteriorated over the past 10 years — can restore the confidence that makes financial markets work.”

In 2003, when McCain was pushing for stronger regulation of Fannie Mae and Freddie Mac, the New York Times noted that it was the Democrats who were against the increased regulation, not Republicans. Massachusetts Democrat Barney Frank, now chair of financial services oversight in the House, was quoted as saying,

”These two entities — Fannie Mae and Freddie Mac — are not facing any kind of financial crisis. The more people exaggerate these problems, the more pressure there is on these companies, the less we will see in terms of affordable housing.”

The Post editorial on Friday went on to list other instances of McCain pushing to regulate these financial institutions, stating,

“Mr. McCain was an early voice calling for the resignation of Securities and Exchange Commission Chairman Harvey Pitt, charging that he “seems to prefer industry self-policing to necessary lawmaking. Government’s demands for corporate accountability are only credible if government executives are held accountable as well.†In 2006, he pushed for stronger regulation of Fannie Mae and Freddie Mac — while Mr. Obama was notably silent. “If Congress does not act, American taxpayers will continue to be exposed to the enormous risk that Fannie Mae and Freddie Mac pose to the housing market, the overall financial system, and the economy as a whole,” Mr. McCain warned at the time.†The Post editorial concluded, “Mr. Obama’s attack does not give a fair reading of the McCain record.â€

Neither did Mr. Benton’s assumptions about McCain’s “deregulation fervor.â€

According to the Center for Responsive Politics, the top three U.S. Senators getting contributions from Fannie Mae and Freddie Mac were Democrats and number two was Senator Barack Obama, a pretty impressive accomplishment for a guy in the Senate for only four years. Do you think the fact that Fannie Mae CEO Jim Johnson is a big fundraiser and former head of his VP search committee had a little something to do with Obama being “notably silent�

Let’s not forget Democratic Senators Christopher Dodd, chairman of the Banking Committee, and Kent Conrad, chairman of the Budget Committee received sweetheart mortgage deals because of their cozy relationships with Countrywide Mortgage CEO Angelo Mozillo. These “friends of Angelo†as they became known were supposed to be regulating Countrywide, not financially benefiting from them.

While on the subject of sweetheart mortgage deals, Barack Obama got one from Northern Trust. The Washington Post reported on July 2 that, “Obama Got Discount on Home Loan†and the story said,

“The freshman Democratic senator received a discount. He locked in an interest rate of 5.625 percent on the 30-year fixed-rate mortgage, below the average for such loans at the time in Chicago. The loan was unusually large, known in banker lingo as a “super super jumbo.†Obama paid no origination fee or discount points, as some consumers do to reduce their interest rates.”

There is plenty of blame to go around for the Wall Street debacle and Republicans deserve their fair share of it. Many of the accounting abuses originated and were allowed to spread like a cancer on their watch. The evidence shows that Democrats have their own problems on this issue, thwarting attempts by McCain to increase regulation while they lined their pockets with campaign contributions from Fannie and Freddie and accepted sweetheart mortgage deals from firms they were supposed to be regulating. All the lipstick in the world can’t change that.

The record shows that rather than displaying “deregulation fervorâ€, Sen. McCain has been out front, for years, on the issue of regulation and Wall Street. This financial crisis is the latest example of Washington, not a political party or figure, failing the American people.

Yesterday, General David Petraeus turned over command of Iraq to his deputy General Ray Odierno. Petreaus is now taking over CENTCOM, which is a great thing for our country. He will now be in charge of all of the Middle East as well as Afghanistan and Pakistan. The leadership that he brought to Iraq at its darkest hours was remarkable. He is a once-in-a-lifetime leader.

Retired Lt. Col. Ralph Peters wrote today,

In the 19 months of the Petraeus era, Iraq evolved from a bloody landscape sliding toward civil war to a land of hope. Urban combat and a literal reign of terror have been replaced by the spreading rule of law, a blossoming economy, LA-quality traffic jams – and the political squabbling that accompanies democracy.

As Petraeus is always the first to note, much remains to be done and much could still go wrong. But every single trend line has turned positive. Al Qaeda’s grip has been broken. (It can still set off bombs, but can no longer set itself up as a champion of Sunni Muslims.) Our troops are coming home at a steady pace. And (dare one say it?) we’re winning.

That last point’s a sore one. Scrupulously avoiding any statement or action that played politics, Petraeus nonetheless changed the terms of our presidential election.

David Ignatius on 20 months in Iraq,

Petraeus did something astonishing here. It wasn’t simply managing the “surge” of U.S. troops, whose precise effects military historians will be debating for years. It was that he restored confidence and purpose for a military that had begun to think, deep down, that this war was unwinnable and unsustainable.

I’m reading Bob Woodward’s new book The War Within. In it, he tells an amazing story about David Petraeus that I had never heard before.

One Saturday morning in September 1991, Petraeus and (Jack) Keane were standing together watching an infantry squad practice assaulting a bunker with live grenades and ammunition. A soldier tripped and fell about 40 yards away and accidentally squeezed the trigger on his rifle. The M-16 round tore trough the “A” over the name tag on the right side of Petraeus’s chest and left a golf ball sized exit wound in his back. If it had hit above the “A” in the “U.S. Army” on his left side, he likely would have died on the spot.

“Dave, you’ve been shot, Keane said as he leaned over his downed colleague. “You know what we’re going to do here. First of all, you’re going to make it, all right?” He kept talking to Petraeus, trying to keep him from slipping into shock. “I want you to stay focused,” he said, clutching the lieutenant colonel’s hand, aware that Petraeus was growing weaker.

“I’m gonna be okay, I’ll stay with it,” he said.

In the local emergency room, a trauma expert shoved a chest tube into Petraeus-an excruciating procedure that makes grown men scream and jolt off the table. Petraeus never moved and let out only a low grunt. “That is the toughest soldier I’ve ever laid my hands on,” the doctor told Keane.

A medivac helicopter flew Petraeus with Keane by his side, 60 miles to Vanderbilt Medical Center in Nashville. Keane had called ahead and requested the best thoracic surgeon available. When they landed on the roof of the hospital, Keane saw a man waiting for them dressed in golf clothes.

“I’m Bill Frist,” said the man who would become majority leader of the U.S. Senate a decade later. “I’m the chief of thoracic surgery here.”

I guess we were lucky to have him in more ways than one.

Who knew Joe Biden was a fiscal conservative? No, not with your money. He’s fiscally conservative with his own money, especially when it comes to charitable giving,

Last Friday, Sen. Joseph Biden, the Democratic candidate for vice president, released his tax returns for the years 1998 to 2007. The returns revealed that in one year, 1999, Biden and his wife Jill gave $120 to charity out of an adjusted gross income of $210,979. In 2005, out of an adjusted gross income of $321,379, the Bidens gave $380. In nine out of the ten years for which tax returns were released, the Bidens gave less than $400 to charity; in the tenth year, 2007, when Biden was running for president, they gave $995 out of an adjusted gross income of $319,853.

I’m not surprised.